Tax Assistant for Excel Professional 7.1

Tax Assistant for Excel Professional 7.1

Tax Assistant for Excel Professional is a custom application written for Microsoft Excel and requires Microsoft Excel 2010/2013/2016/2019/365. It simplifies your Federal Income Tax preparation by providing an Excel workbook with IRS-approved alternative forms to Form 1040 and Form 1040A with Forms A, B, C, C-EZ, D, E, SE, Forms 6251 (AMT), 4952, 6781, 8829, 8949 and 8995. There are also several worksheets related to deductions and Schedule D covering Benefits Social Security, Qualified Dividends, and Capital Gains Taxes.

In addition to the more common income reporting, you can report income from up to five different businesses, rents, royalties, estates, and trusts, as well as income from partnerships and S. Tax Assistant for Excel Professional corporations are exact copies of the actual forms and are approved by the IRS. Although the program will help you prepare your taxes, it requires you to follow some IRS guidelines to complete your tax return accurately.

Features of Tax Assistant for Excel Professional

- Simple and easy tax preparation.

- User-friendly software.

- Update tax information.

- Includes error checking tool to increase capital.

- Zpay PayWindow Payroll System 2023 v21.0.8.0

A software solution salary calculator is designed to help you manage transactions and payments for its employees

A software solution salary calculator is designed to help you manage transactions and payments for its employees - Trancite ScenePD 8.1.3.26581

Crime scene and crime scene mapping software, providing comprehensive tools for both accident scene diagramming

Crime scene and crime scene mapping software, providing comprehensive tools for both accident scene diagramming - SOFiSTiK Structural Desktop 2024.0.1 SP0 Build 3

A software application used for structural analysis and design in civil and structural engineering

A software application used for structural analysis and design in civil and structural engineering - RIGOTECH Pre-Cut Optimizer Pro 4.6.24

A software program designed to optimize cutting patterns for sheet materials such as plywood, MDF

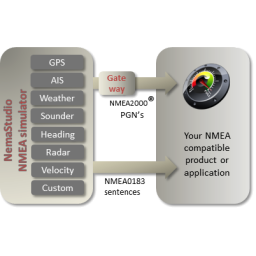

A software program designed to optimize cutting patterns for sheet materials such as plywood, MDF - NemaStudio 1.36.6465.25714

Versatile tool for simulating AIS and Radar targets and many other marine devices

Versatile tool for simulating AIS and Radar targets and many other marine devices - Mecway 28.0

A comprehensive user-friendly finite element analysis package for Windows

A comprehensive user-friendly finite element analysis package for Windows - Ideate Software Apps Bundle 2025.0 For Revit 2022-2025

Linking Revit and Excel allows you to export data from Revit to Excel greatly reducing the time it takes

Linking Revit and Excel allows you to export data from Revit to Excel greatly reducing the time it takes - Cadence Celsius EC Solver 2023.2 HF2

Electronic cooling simulation software to accurately and quickly analyze the thermal performance of electronic systems

Electronic cooling simulation software to accurately and quickly analyze the thermal performance of electronic systems - Autodesk FeatureCAM Ultimate 2026

A powerful computer-aided manufacturing (CAM) software designed to help manufacturers create CNC programs

A powerful computer-aided manufacturing (CAM) software designed to help manufacturers create CNC programs - Autodesk Fabrication CADmep 2026

software for mechanical, electrical and plumbing (MEP) contractors and manufacturers

software for mechanical, electrical and plumbing (MEP) contractors and manufacturers